You know that moment when you open a payslip and your stomach starts shrinking? The numbers look “fine”, but the deductions kind of feel personal. If you’ve ever wondered where that line is between “I’m earning” and “I’m suddenly paying tax”, you’re not alone in this. At Afriex, we hear this a lot from people who send money home each month. One payslip looks different, and suddenly your plan changes. That’s especially true when you send money to Ghana, Nigeria, or Kenya from UK and you’re trying to stay consistent.

Most confusion starts with not understanding what the personal allowance actually does. It sounds like a dry HMRC phrase. Yet it decides how much of your salary can be tax free income. And once you understand it, a lot of those “why am I being taxed?” moments will eventually stop feeling so random.

What Is the Personal Tax Allowance

Your personal allowance is the amount you can earn each tax year before you start paying income tax. You can think of it as your tax-free starting line. Once you earn more than your personal allowance, only the extra income is taxed, using the standard UK tax bands and rates.

Under PAYE tax, your employer spreads this allowance across your payslips through your tax code. For the 2025/26 tax year, the standard personal allowance is £12,570. However, it can increase with things like Marriage Allowance or Blind Person’s Allowance. On the other hand, it can shrink if you’re a high earner, or if HMRC is collecting tax you owe from a previous year.

Personal Allowance vs Tax-Free Allowance: Is There a Difference?

Most people use the concepts of tax free allowance, tax allowance, and personal tax allowance interchangeably. In everyday chat, they usually mean the same thing: the chunk of income you don’t pay tax on.

The personal allowance is the core one for most people. Then you’ve got other tax-free allowances, like the marriage tax allowance (sometimes people call it “marital allowance”). This is a UK tax rule for married couples and civil partners. It lets the lower earner transfer up to £1,260 of their personal allowance to their partner. That transfer can reduce the other partner’s tax by up to £252 for the year. You’ve also got the Blind Person’s Allowance, which is an extra tax-free allowance if you’re registered blind or severely sight impaired ( £3,130 in 2025/26).

How Personal Allowance Works in the Current UK Tax Year

The current tax year in the UK runs from 6 April to 5 April. It doesn’t follow the calendar year, which catches people out.

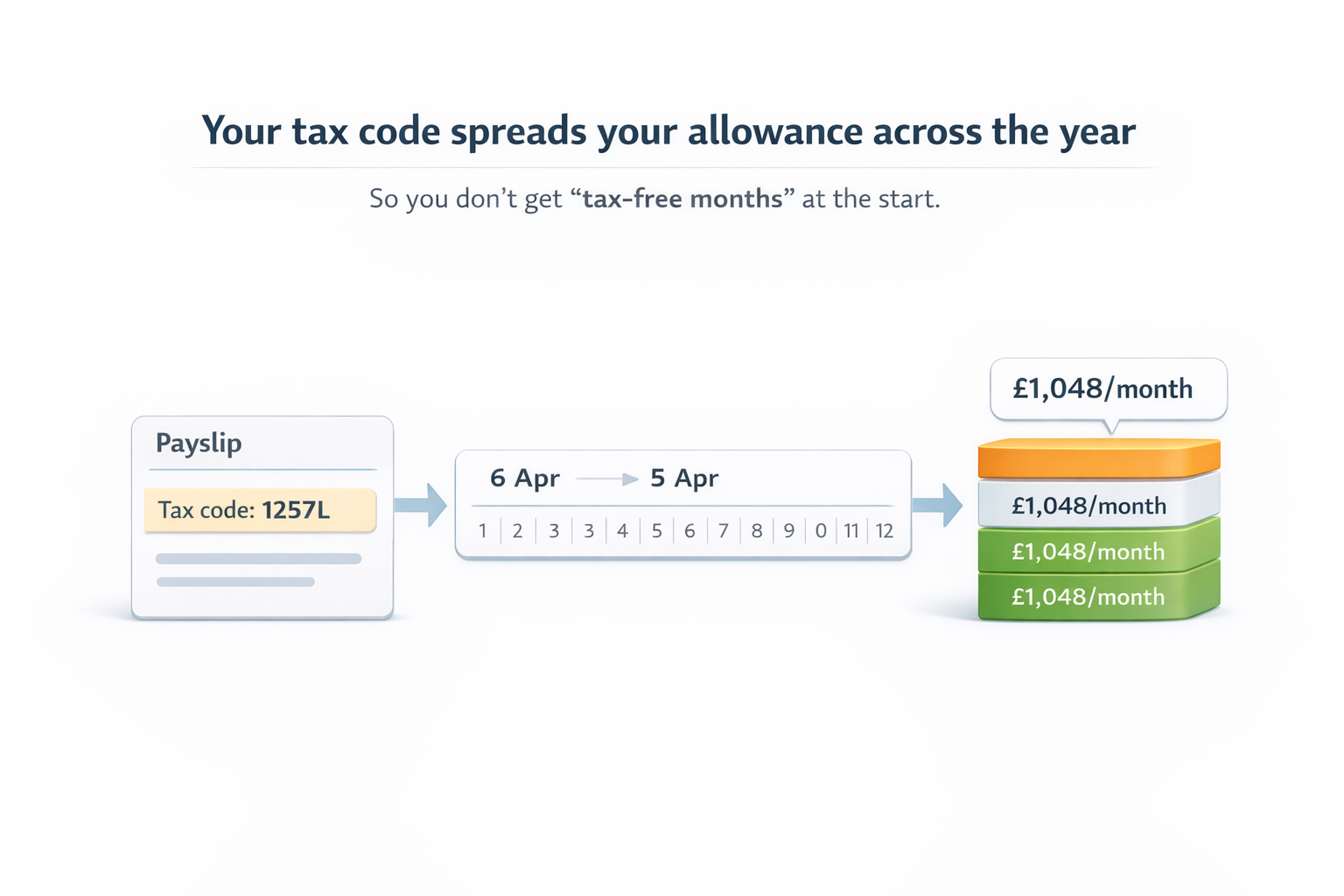

For the 2025 to 2026 tax year, the standard personal allowance is £12,570. That’s also shown as £1,048 per month or £242 per week in PAYE guidance. And here’s the part that should matter to you: the personal allowance isn’t handed to you as one big “free” block. Under PAYE, it gets spread out across payslips using your tax code. That’s why you don’t get several “tax-free months” and then suddenly get hit later.

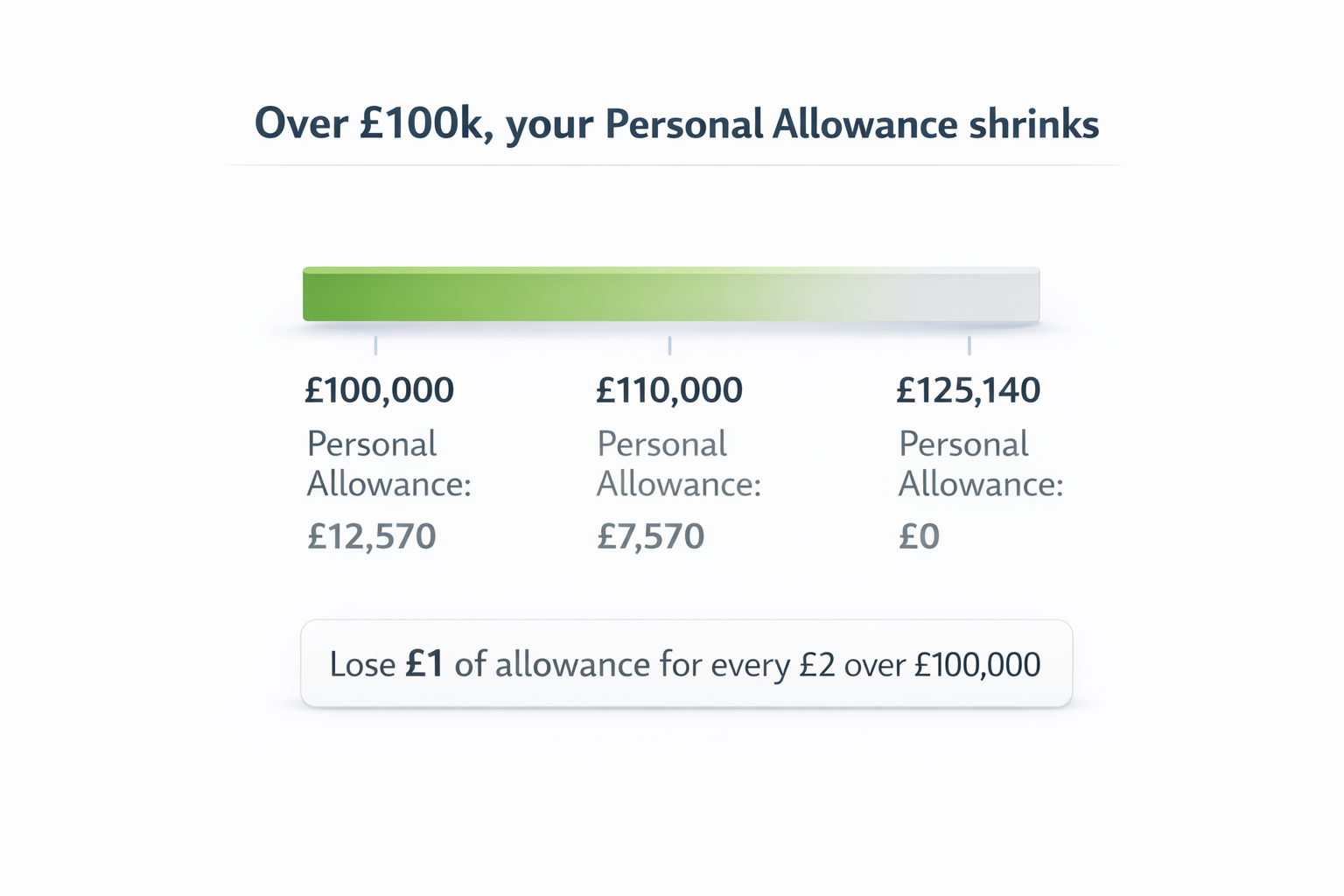

If You Earn Over £100,000

This is where the personal allowance starts to shrink. Once your income goes above £100,000, you lose £1 of allowance for every £2 over that line. By £125,140, your personal allowance is effectively gone. People often call this the “£100k trap”. It sounds dramatic, but it’s just how the allowance tapers.

Personal Allowance for Pensioners

In this case, the basic rule stays the same: you pay tax if your total income is above your personal allowance. What changes is how tax gets collected, especially with the State Pension.

PAYE Taxation: Why Your Payslip Changes

If you’re employed, your pay usually goes through PAYE tax. That means your employer deducts income tax before you even see your pay land. Your tax code is what tells payroll how to apply your personal allowance. The common code 1257L points to the standard £12,570 allowance. It’s basically HMRC saying, “Give this person that much tax-free space across the year”.

Now, why do payslips change?

Because PAYE can work cumulatively. It keeps a running total across the tax year. So if your pay goes up, or you start mid-year, or HMRC updates your record, your next payslip can look very different. That’s not you doing something wrong, but the system adjusting itself. And yes, forums are full of people asking “is my tax code broken?” for this exact reason.

How Much Can You Earn Before Paying Tax in the UK?

For income tax, in the 2025/26 tax year, the headline number is usually £12,570 because of the personal allowance. But there is an important nuance: many people say “tax” when they mean “anything deducted”. Your payslip can include other deductions even when income tax is low.

For example, National Insurance has its own thresholds. In 2025/26, the employee Primary Threshold is shown as £1,048 per month in the NI thresholds guidance (that number often looks familiar because it matches the monthly personal allowance figure, but it’s a separate system).

Personal Allowance and UK Tax Bands

Once your income goes beyond your personal allowance, the rest gets taxed in layers using UK tax bands.

For England, Wales, and Northern Ireland, GOV.UK explains the idea simply: how much you pay depends on how much income sits above your personal allowance, and how much falls into each band.

People also ask, “how much can I earn before I pay 40 tax”. That’s basically asking when you enter the higher rate band. In the standard UK setup (outside Scotland), that higher rate starts once your taxable income crosses the higher-rate threshold.

For the 2025/26 tax year, that threshold is £50,271 in England, Wales, and Northern Ireland. You can earn up to £50,270 before any income is taxed at 40%. This often causes confusion, but the UK uses a marginal tax system. That means you do not pay 40% on everything you earn. You only pay 40% on the portion of income above the threshold. Everything below it stays taxed at the lower rates.

Scotland is its own story. Income tax bands and rates differ there. So two people on the same salary can pay different income tax, depending on where they live.

Finally, tax codes can make things look more confusing than they are. Many people see a code like 1257L, which usually reflects the standard personal allowance. If your tax code is wrong, your payslip can look like you are paying higher-rate tax too early. On top of that, because income tax thresholds are frozen for several years, more people will gradually move into the 40% tax bracket without feeling any richer.

What Is Taxable Income in the UK?

Most of what you earn counts as taxable income in the income tax UK system. HMRC looks at your total taxable income, not just your main salary. This can include bonuses, overtime, dividends, rental income, and most savings interest.

Still, some income is often non-taxable. For example, casual competition winnings or Premium Bond prizes are usually tax-free. Also, some compensation can be non-taxable. This can include certain redundancy payments, or personal injury compensation, depending on details. In addition, some welfare benefits are non-taxable, but not all.

ISAs are worth mentioning here. Interest and dividends inside an ISA wrapper are exempt from income tax. So, they do not increase your total taxable income. As a result, they don’t push you closer to the UK income tax thresholds.

If income is non-taxable, you usually do not need to report it to HMRC. You also don’t include it when you calculate tax. But if income is taxable, you must use the gross amount. That means the figure before any tax was taken off. This is the part where people get sort of confused. Your yearly gross income is what you earn before deductions. A lot of people use “gross” and think “that’s my taxable amount”. But it doesn’t work like that. HMRC applies allowances and rules first. And only what’s left becomes taxable.

This is also why a personal allowance matters so much. HMRC uses it to reduce what gets taxed in the first place. Then, the remaining taxable income gets taxed across the tax bands.

Why You Might Be Taxed Too Much at First

If your first payslip feels harsh, usually it’s one of these situations.

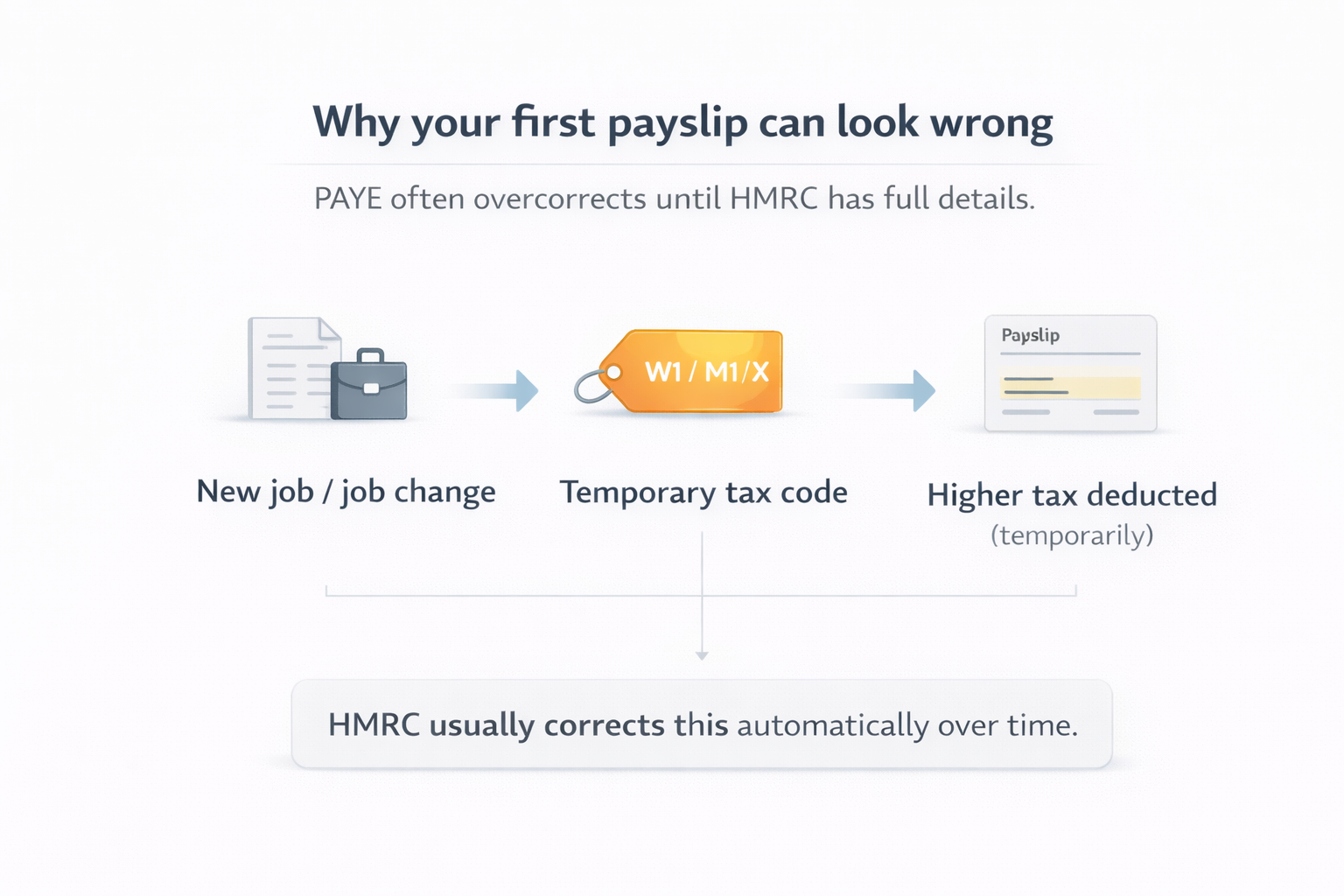

Sometimes your employer doesn’t have your full details yet, like no P45, or you’ve just switched jobs, or payroll hasn’t received the right HMRC update. In that case, you can land on an emergency tax code (you’ll often see W1, M1, X, or “NONCUM”). That’s HMRC’s way of saying, “We’re going to tax this pay in isolation until we can link it properly to the rest of the year”.

Basically, this often happens after a change like starting a new job, and it’s usually temporary.

It can also happen if you have a second job tax situation. Your main job might use your personal allowance, and your second job might use a code like BR, meaning it’s taxed without that allowance. People often only notice this once they get the payslip.

And then there are taxable benefits. A company car is the classic one. It can reduce your tax-free “space” through your code, so you pay more via PAYE even if your salary hasn’t changed.

A basic income tax estimator UK tool can help you see if your net pay is broadly reasonable. But remember that the final referee is still HMRC.

HMRC Income Tax Account: How to Check Your Personal Allowance

You can sign in by clicking the link above and check your Income Tax for the current year. That service lets you see your tax code, personal allowance, and estimated income for the year. You can also update details if something is wrong.

This is where you go when you’re asking yourself: “Do I pay income tax correctly?” or “How much tax should I pay based on what I earn?”. It won’t answer every edge case, but it shows your baseline and often explains more than a simple calculator.

Self Assessment Criteria: When You Want to Do It Yourself

Most employees never need Self Assessment, because PAYE covers them. But you may need Self Assessment if you had certain types of income or situations. GOV.UK lists common triggers, like being self-employed and earning over £1,000 (before expenses), being in a partnership, owing Capital Gains Tax, or having untaxed income.

How Income Tax Is Calculated After Personal Allowance

In plain terms, HMRC does this: They start with your income for the year. Then they apply your personal allowance. What’s left becomes your taxable income. After that, they apply income tax rates based on the bands your taxable income falls into.

Here’s a simple example. Let’s say your yearly gross income is £30,000 in 2025/26. If you get the standard personal allowance (£12,570), your taxable income becomes £17,430. Then income tax is calculated using the relevant tax bands for your nation (England/Wales/NI vs Scotland).

If you’re trying to figure out income after taxes, remember there are different types of deductions. Income tax is one. National Insurance is another. Pensions and student loans can add more. That’s why two people on the same salary can take home different amounts.

Final Thoughts

If your payslip ever feels confusing, most surprises come from your personal allowance, your tax code, or timing. PAYE spreads things across the year, so it can look weird month to month. We recommend you to start simple. Check your personal allowance, then check your UK tax bands. After that, look at your tax code and if something still feels off, your HMRC account usually explains why.

This matters even more if you send money abroad as part of your routine. When you understand your baseline pay, you can plan your transfers with less stress. For those looking to send money to Africa from UK, Afriex is a convenient and reliable money transfer app that simplifies international remittances.

Download the Afriex app on iOS or android to manage your money smarter in the UK.

Common Income Tax Situations That Confuse People in the UK (FAQ)

Why Does My First Payslip Look Wrong Or Lower Than Expected?

It usually looks “wrong” because you’re seeing the full reality for the first time. PAYE income tax can show up alongside National Insurance, pension contributions, and anything else your employer deducts.

Also, your personal allowance doesn’t arrive as a single tax-free chunk at the start of a job. Under PAYE taxation, it’s spread across the tax year through your tax code. So the system doesn’t “wait” until you’ve earned £12,570 and then begin taxing you. It taxes you in a pattern designed to match your expected yearly income.

If you started a new job mid-year, the cumulative method can make the first payslip look weird while it catches up. If payroll didn’t get your details quickly, you might also be temporarily taxed in a way that feels heavier. HMRC usually settles things over the year, and any overpayment is normally corrected in your code or refunded after the tax year ends.

Why Am I On An Emergency Tax Code And What Happens Next?

You’re on an emergency tax code if your code ends in W1, M1, or X (sometimes “NONCUM” shows up too). That means your tax is being worked out without using the normal cumulative picture for the year.

This often happens when HMRC or your employer doesn’t yet have the full info, like when you start a new job and there’s no P45. With an emergency code, your tax is worked out just on that week’s or month’s pay, as if you’ll earn that amount all year. That can mean you pay more tax than you really owe for a while.

Once HMRC receives the right details, they issue a new tax code. Your payroll then adjusts, and you either pay less tax in future months or get some of the overpaid tax back. If things aren’t fixed during the year, HMRC can send you a P800 or similar letter after the tax year to sort any refund or underpayment.

How Do I Know If I Need To Tell HMRC About My Income?

If you have one normal job, taxed through PAYE, HMRC usually handles it automatically through your tax code. You typically don’t need to do anything extra.

You do need to speak up when you have income that isn’t being taxed at source. Common examples are self-employment (especially over £1,000), certain rental income, some overseas income, or other untaxed income. That’s where Self Assessment often comes in.

If you have more than one job, it’s also worth checking, because each job has its own code and that can affect your personal allowance usage. You should inform HMRC about a new job or more than one job, because delays can push you onto temporary codes.

What Is A Tax Year, And Does Starting Mid-Year Change Anything?

In the UK, the tax year runs from 6 April to 5 April. Starting mid-year doesn’t mean you pay more income tax overall. It just means the first month or two can look odd while PAYE aligns your allowances and taxes with what you’ve earned so far.

If you start in, say, October, PAYE may calculate tax based on the portion of personal allowance you’ve “built up” by that point in the tax year. That adjustment can create a bigger or smaller deduction than you expected. But the goal is still the same: get your total tax right by the end of the year.

Why Was I Taxed Even Though I Earn Under The Personal Allowance?

This one feels unfair, but it usually comes down to how PAYE estimates things.

PAYE doesn’t wait for you to hit the full personal allowance. It looks at your pay so far and often assumes you’ll keep earning at that pace for the rest of the year. If that projection suggests you’ll go over the allowance, it starts taking income tax. If your income later drops, you may end the year under the allowance and be due a refund once HMRC reconciles everything.

It can also happen if you’ve already used some of your tax-free allowance earlier in the same tax year, maybe in another job, or because of taxable benefits.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.png)

.png)