Sending money to Africa has never been more important—or more complex. Millions of people send funds every day to support loved ones, pay for education, or cover business expenses. Traditionally, bank transfers were the standard. But in recent years, mobile money has become a powerful alternative, especially across African markets like Kenya, Ghana, and Nigeria.

Take James, a software engineer in Texas as an example. He sends money to his younger sister in Nairobi to cover her university fees. For years, he used banks—only to realize that between high fees and poor exchange rates, he was losing $50–$70 per transfer. That’s nearly a whole week’s groceries in the U.S.!

Then one day, a friend told him about mobile money. Suddenly, transfers became faster, cheaper, and far more convenient. But James still wondered: is mobile money always the best way? Or do banks still have an edge in some cases?

That’s exactly what we’ll explore here.

What Exactly Is Mobile Money?

If you’ve ever been to Kenya, Ghana, or Nigeria, chances are you’ve heard of M-Pesa, MTN Mobile Money, Airtel Money, or Opay. Mobile money is simply a digital wallet linked to your phone number.

It allows anyone—even people without a bank account—to:

- Receive money instantly

- Pay bills

- Buy goods or services

- Transfer money across borders

For families back home, this is a game-changer. Imagine your mom in Lagos receiving your transfer in seconds, then paying for electricity straight from her phone—no bank queues, no paperwork.

The Case for Bank Transfers

Now, banks aren’t completely out of the picture. Some people still prefer them for a few reasons:

- Large transactions: Banks sometimes allow bigger amounts than mobile wallets.

- Familiarity: Older generations may feel more comfortable with banks.

- Regulation and formality: Banks are fully regulated, which gives peace of mind.

But here’s the catch: bank transfers are often slow, expensive, and frustrating. It’s not unusual for a transfer to take 3–5 business days. And fees? Between $20–$50 per transfer, plus poor exchange rates. That’s money that never reaches your loved ones.

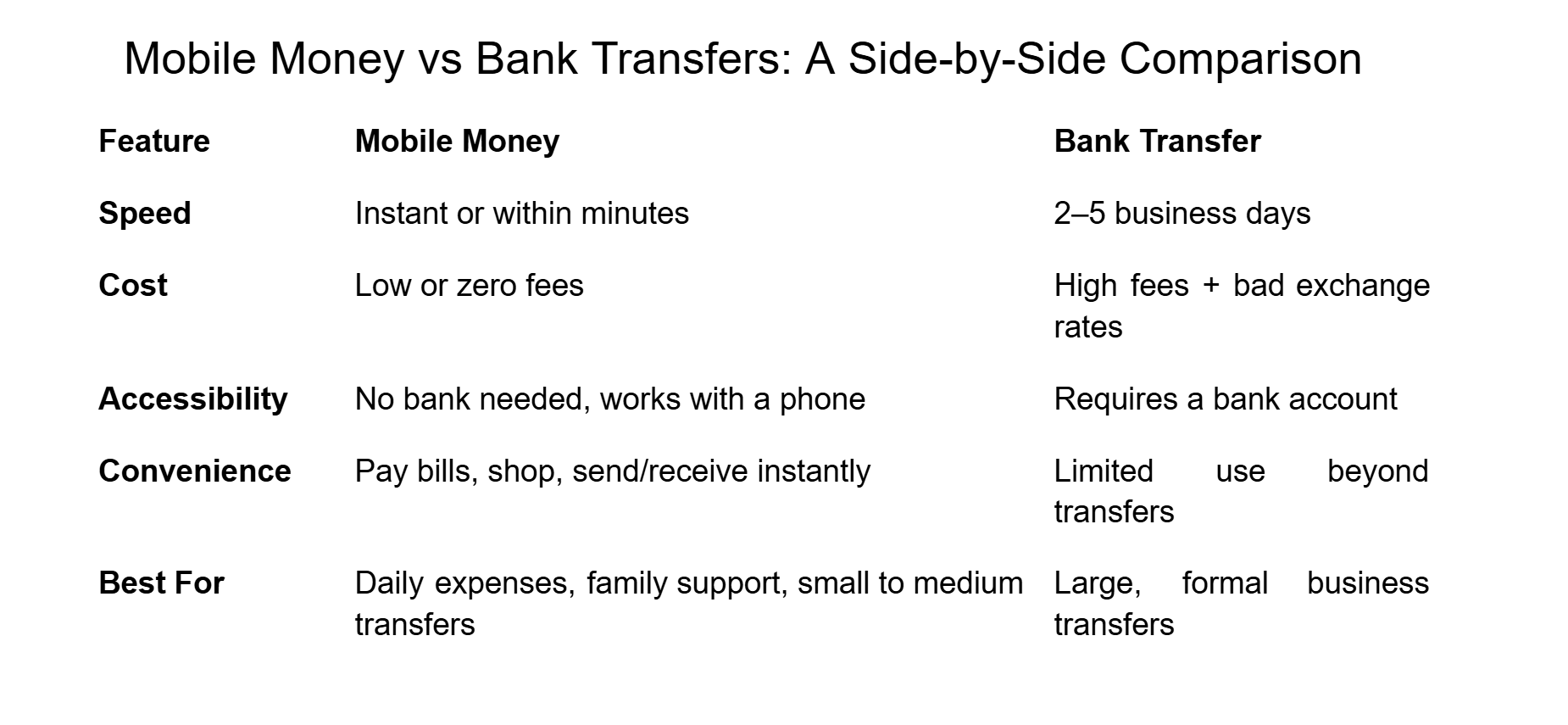

Mobile Money vs Bank Transfers: A Side-by-Side Comparison

Why Afriex Makes the Choice Easy

Here’s where Afriex steps in. With Afriex, you don’t have to choose between the speed of mobile money and the security of banks—you get the best of both worlds:

- Zero fees on transfers

- Competitive exchange rates (no hidden markups)

- Fast delivery (often instant)

- Flexibility: Send to mobile wallets or bank accounts across Africa

So, James doesn’t lose $50 anymore. His sister gets her school fees instantly, and he keeps more money in his pocket. That’s the power of Afriex.

Scenario: A Parent’s Perspective

If we take a case scenario and look at it from a parent’s perspective, consider Angela, a nurse in the UK. She sends money every month to support her parents in Ghana. With banks, she used to send £200, but by the time fees and rates were applied, her parents got only about £170 worth in Ghanaian cedis.

Now, with Afriex, she sends £200, and her parents receive almost the entire amount in minutes—directly to their MTN Mobile Money wallet. That’s groceries, utilities, and peace of mind covered without stress.

The Bottom Line

If you want speed, convenience, and affordability, mobile money beats bank transfers hands down. And if you want the best possible rates with zero fees, Afriex takes it one step further.

Your family shouldn’t lose money just because you’re supporting them from abroad. With Afriex, every dollar, pound, or euro counts—just the way it should.

Download Afriex today on your iOS or android and experience the smarter way to send money.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.png)

.png)